Individual Investors Act › Puerto Rico Tax Incentives

On January 17, 2012, Puerto Rico enacted Act No. 22 of 2012, as amended, known as the “Individual Investors Act” (the “Act”). The Act may have profound implications for the continued economic recovery of Puerto Rico. The Act provides tax exemptions to eligible individuals residing in Puerto Rico. To avail from such benefits, an individual needs to become a resident of Puerto Rico and apply for a tax exemption decree.

Eligibility

The benefits of Act No. 22, are only available to bona-fide residents of Puerto Rico that were not bona-fide residents of Puerto Rico for the 6-year period preceding the enactment of the Act on January 12, 2012 (“Eligible Individuals”). Generally, a bona-fide resident of Puerto Rico is a person who: (1) is present for at least 183 days during the taxable year in Puerto Rico; (2) does not have a tax home outside of Puerto Rico during the taxable year; and (3) does not have a closer connection to the United States or a foreign country than to Puerto Rico.

Although Puerto Rico is a U.S. territory, pursuant to Section 933 of the U.S. Internal Revenue Code of 1986, as amended, bona-fide residents of Puerto Rico are not subject to U.S. federal income taxes on income derived from sources within Puerto Rico.

Therefore, U.S. citizens that are bona-fide residents of Puerto Rico benefiting from the Act will only be subject to federal income taxation on income derived from sources outside of Puerto Rico.

Tax Exemptions

The Act is designed to primarily attract to Puerto Rico high net worth individuals, empty nesters, retirees who currently relocate to other States and investors from U.S. and other countries. The Act provides the following benefits to new Puerto Rico bona-fide residents on qualified investments:

• 100% tax exemption from Puerto Rico income taxes on

all dividends;

• 100% tax exemption from Puerto Rico income taxes on

all interest; and

• 100% tax exemption from Puerto Rico income taxes on

all short-term and long-term capital gains accrued after

the individual becomes a bona-fide resident of Puerto Rico

(“Puerto Rico Gain”).

Built-in Capital Gains

Also, capital gains realized by an Eligible Individual, but accrued before the individual became a bona-fide resident of Puerto Rico (“Non-PR Built–in Gains”), will be subject to preferential Puerto Rico income tax rates. If such gain is realized and recognized within 10 years after the date residence is established in Puerto Rico, it will be taxed at the income tax rate for capital gains applicable for the tax year in which the gain is realized (currently the capital tax rate is 10%) and at a 5% income tax rate if such gain is realized and recognized after

said 10-year period. Pursuant to U.S. income tax regulations, U.S. residents moving to Puerto Rico will be subject to federal income taxes on any Non-PR Built-in Gains realized within 10 years after moving.

However, Puerto Rico income taxes may be creditable against such federal income tax, and therefore, U.S. residents moving to Puerto Rico and realizing Non-PR Built-in Gains within a 10-year period after moving may only be subject to the excess of U.S. taxes over Puerto Rico taxes on such Non-PR Built-in Gains. In

other words, under current law and tax rates, such individuals may only pay income taxes for the Non-PR Built-in Gains in an amount equal to the federal income tax rate imposed on such Non-PR Built-in Gains.

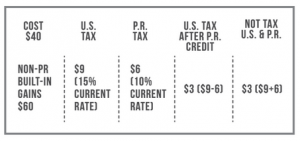

Example 1

For example, if stock from a publicly traded

company is acquired by a U.S. resident in 2006 for $40 and is

worth $100 just before moving to Puerto Rico in 2012, and

then it is sold by the Puerto Rico resident on 2018 for $200, the

individual will be subject to income taxes for the gain realized

on the sale as follows:

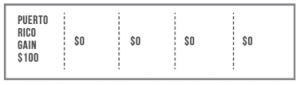

After 10 years of moving from the U.S. to Puerto Rico, the

income tax on the Non-PR Built-in Gains will not apply and

bona-fide residents of Puerto Rico will only be subject to a 5%

Puerto Rico income tax on any portion of the Non-PR Built-in

Gain realized after 10 years from moving to Puerto Rico.

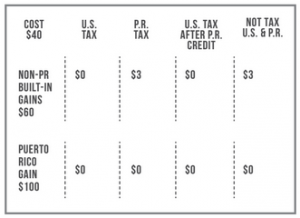

Example 2

If the stock acquired by the U.S. resident in Example

1 is sold by the Puerto Rico resident on 2023 for $200, the

individual will be subject to income taxes for the gain realized

on the sale as follows:

Tax Exemption Decree

To benefit from the Act, the individual investor needs to submit

an application with the Office of Industrial Tax Exemption

of Puerto Rico to obtain a tax exemption decree, which will

provide full detail of tax rates and conditions mandated

by the Act and will be considered a contract between the

Government of Puerto Rico and the individual investor.

Once the individual investor obtains the tax exemption decree, the

benefits granted will be secured during the term of the decree,

irrespective of any changes in the applicable Puerto Rico tax

laws. The term of the decree will be until December 31, 2035.